Discover the AI advantage

See how businesses benefit from Omni Engage chatbots

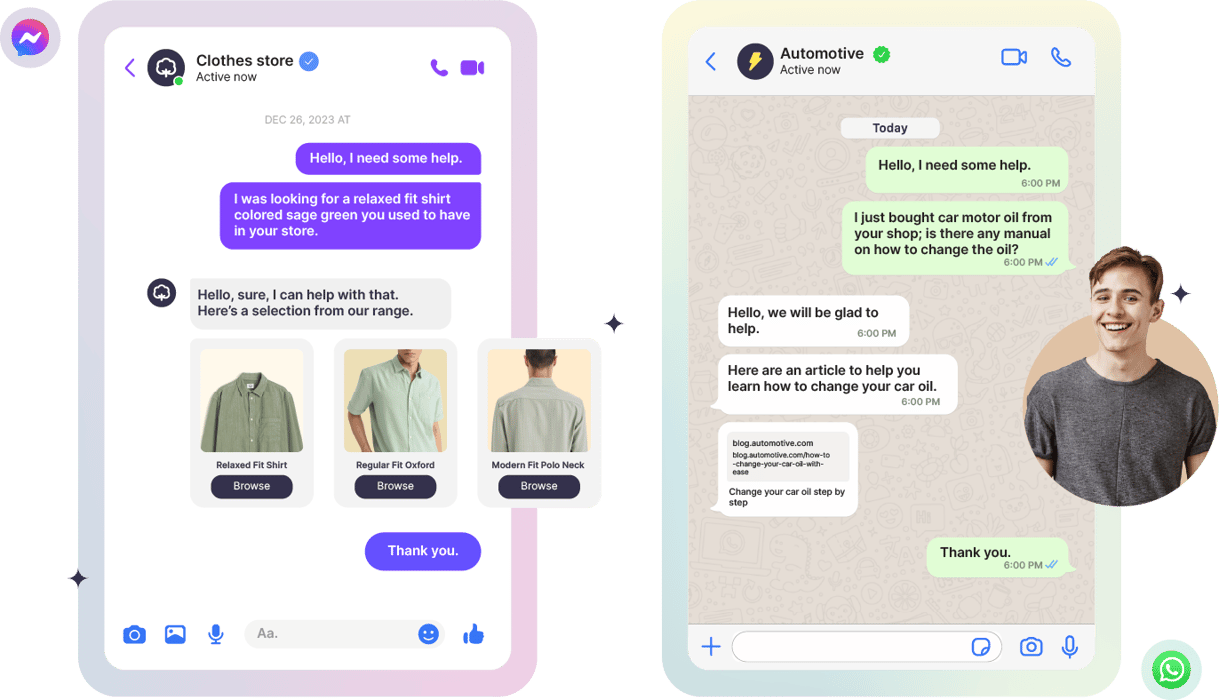

Automate product discovery to drive sales

Are you struggling with a high volume of inquiries? With our AI Bot you can support the sales process by automating product discovery through natural language interactions or guided menus, and offer personalized product recommendations in multiple languages and channels. Discover how you can elevate your sales process, providing customers with a seamless and personalized product discovery experience.

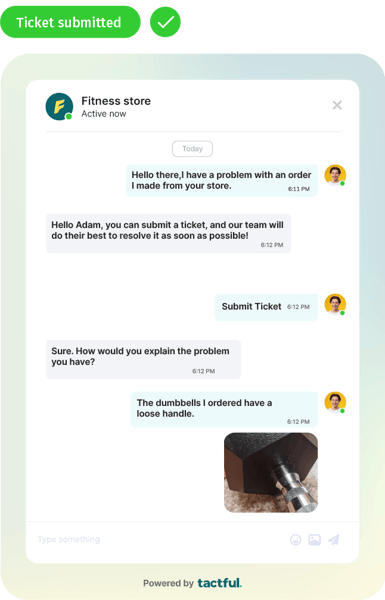

Efficient ticket management for streamlined Customer Support

Grappling with cumbersome ticket collection, time-consuming data entry or customer complaints? Streamline ticket collection through AI-driven intent detection, allowing customers to report issues efficiently . Explore how our Support Bot can optimize your support processes, leading to improved customer experiences and operational efficiency.

Enhancing Customer Engagement

Using AI chatbots

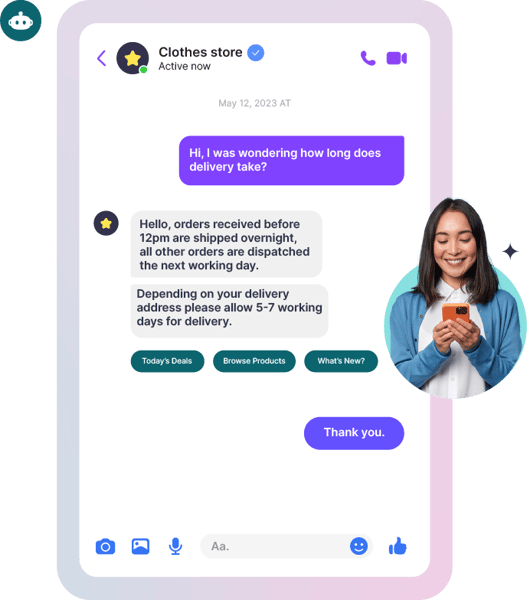

Streamline Customer Interactions

Improved response times, enhanced efficiency, and higher customer satisfaction are just a few of the benefits bots can deliver.

Use our Omni Engage AI chatbots to automate routine inquiries, reducing customer wait times and enable agents to focus on more complex issues. Find out now how you can deliver faster query resolution and improved customer experiences.

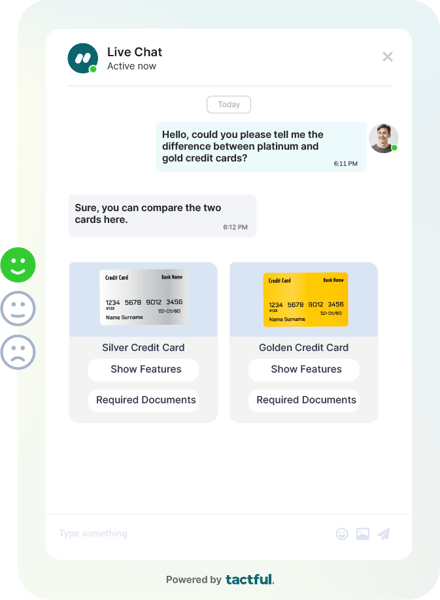

Ensure Consistency & Accuracy

Build brand reputation and improve customer loyalty by delivering timely and accurate information across every channel.

Omni Engage AI chatbots provide consistent responses to customer inquiries, eliminating human errors and ensuring that every customer receives the same high-quality service. Engage now.

Boosting Productivity & Cost Savings

Increasing productivity and reduced support costs are essential for business growth and profitability. Using Omni Engage AI chatbots you can handle repetitive discussions with ease, freeing up agents to tackle more complex issues.

Implementing a chatbot offers significant cost savings and improved productivity, as agents can focus on value-added tasks. Explore how you can save.

Multilingual Support & Scalability

Catering to diverse customer bases and adapting to business growth are key to long-term success. AI chatbots support multiple languages, allowing businesses to serve a global customer base effectively.

They also scale effortlessly with your business, ensuring that customer support remains seamless as you expand.

Transform your business with Omni Engage

AI-powered chatbots in action

-

Handling Customer FAQs

-

Answering Product Enquiries

-

Automating Ticket Creation

-

Automate Human Handovers

-

Great Greetings, engage sooner

-

Conversational AI

-

Fallback

Handling Customer FAQs

Business Problem

High load of incoming repetitive inquiries, inefficient customer support processes, insufficient support staff or resources, and ineffective knowledge management.

Solution

Configure answers for FAQs and train AI models to recognize end-customer intents, delivering quick, consistent responses in multiple languages and channels.

Answering Product Enquiries

Business Problem

High load of inquiries regarding product specifications and information, inefficient support processes, and limited product knowledge.

Solution

Automate product discovery through natural language interactions or guided menus, offering personalized product recommendations in multiple languages and channels.

Automating Ticket Creation

Business Problem

Cumbersome ticket collection, time-consuming data entry, and customer complaints.

Solution

Streamline ticket collection through AI-driven intent detection, allowing customers to report issues efficiently in multiple languages and channels.

Automate Human Handovers

Business Problem

AI limitations in handling complex inquiries.

Solution

Seamlessly transition from AI to human agents, ensuring customers receive the support they need promptly and effectively.

Great Greetings, engage sooner

Business Problem

Lack of professional greetings at the beginning of conversations.

Solution

Personalize conversations with a customizable greeting skill, enhancing the customer's initial experience.

Conversational AI

Business Problem

Inability to understand customer intents quickly and effectively.

Solution

Train and configure the conversational AI model to recognize customer intents, enabling automated responses and efficient customer interactions.

Fallback

Business Problem

AI misunderstandings or system failures.

Solution

Implement a general fallback skill to guide customers towards valid inputs and maintain smooth conversations.

Frequently Asked Questions

What is a chatbot?

A chatbot is an AI-powered tool designed to simulate human-like conversations, providing automated responses to user queries.

Do you offer chatbot templates?

Yes, Omni Engage provides customizable chatbot templates to streamline the Chatbot implementation process for various purposes, such as sales and customer support.

What are bot-supported channels?

Bot-supported channels refer to the platforms or communication channels where chatbots, like those powered by Omni Engage, can interact with users. This includes websites, messaging apps, and social media.

Can I use artificial intelligence to build WhatsApp chatbots?

Absolutely, Omni Engage allows you to leverage artificial intelligence to build powerful WhatsApp chatbots for enhanced customer engagement and support.

How much do WhatsApp chatbots cost?

The use of WhatsApp for inbound conversations is free, you only pay for bot interactions according to your chosen plan.

Is it possible to create quick answers or buttons?

Yes, Omni Engage allows you to create quick answers or buttons for a more interactive and user-friendly chatbot experience.

What is the cost of an AI Bot?

The usage fee is based on the number of conversations conducted between a customer and the AI bot. A conversation is a customer-initated thread of messages on a single channel and ends when an human joining the conversation or after 24 hours of inactivity, whichever occurs first.

What is a Bot conversation?

What is the difference between a Omni Engage Bot and ChatGPT Bot?

Is Omni Engage Bot GDPR compliant?

Can I integrate Omni Engage with ChatGPT?

Omni Engage has an agnostic approach to AI models which enables customers to use alternative AI models, such as ChatGPT.